Crossword answers will appear within the Newsletter section of the Funds website in fifteen days.

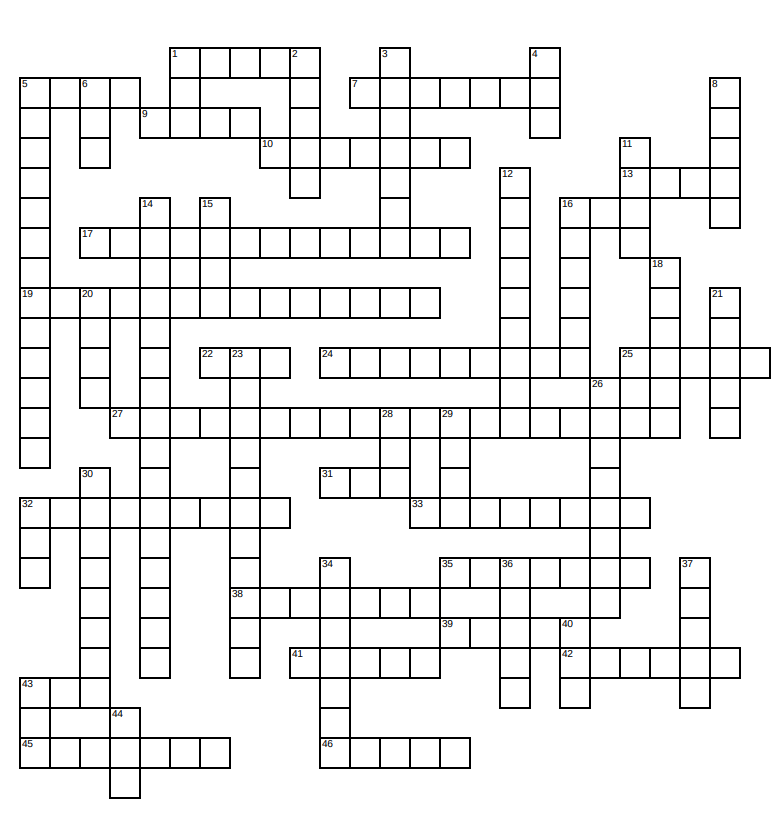

ACROSS

1. Failure to make timely self-payments will result in coverage to be terminated and the issuance of a ________notice

5. _______, incorrect or no self-payments will lead to a participant’s termination of coverage

7. In between a work quarter and quarter of coverage exists an administrative _________

9. Abbreviation for the Medicare advantage with part D program

10. HRA credit balances are a Health and Benefit Plan __________

13. Abbreviation of the physician network provided to active participants and early retirees

16. Abbreviation of the Health and Benefit Plans vision provider

17. Term used to describe the value of each years vested credit

19. Year Local 697 was chartered

22. Abbreviation for the document that explains how the plan works and what benefits a participant is entitled to receive

24. Convenient monetary instrument that allows you to draw upon HRA credit balances

25. Name of the Health and Benefit Plans pharmacy benefit manager

27. Upon obtaining the age of 59 ½ a participant may access half of their MPP&T balance up to a maximum of $100,000 provided they experience a 30-consecutive day __________

31. 130% of 70% of Medicare allowable payment is the formula utilized to calculate the payment for services rendered by a _____-of-network provider

32. Self-payment expense for medical, dental, vision and pharmaceutical benefits for retirees over the age of 65 was reduced by 12.6% or $80 a month on January 1, 20____

33. What is needed to be submitted to substantiate any HRA debit card transaction

35. On January 1, 2021, the Plan P benefit for covered retirees over the age of 65 was increased from fourteen to ___________ dollars per credit

38. Because the I.R.S. considers Sub Fund benefits to be income, SubFund proceeds are ___________in the year they are distributed

39. Effective July 1, 2021, participants with _______ pension credits can retire early without their monthly pension benefits being reduced

41. Percentage increase in retiree dental benefits in 2021 Effective January 1, 2021, the new pension credit rate is ________ dollars and 75 cents

43. Maximum vesting benefit that can be earned in any given year

45. If your MPP&T loan is defaulted, the outstanding balance becomes ___________

46. Number of calendar days a participant has to submit documentation to substantiate their HRA debit card transaction or HRA reimbursement request

DOWN

1. Abbreviation of the mutually approved compact between the Union and Employer

2. New voluntary contribution provision allows participants to contribute to their MPP&T account on a ______ tax basis

3. If you are receiving State unemployment compensation benefits you may draw upon the__________

4. ___regulations require the Plan to continue to track and calculate interest on deemed loans

5. Local 697’s jurisdiction covers 100% of _______ Counties

6. Upon their applying for a pension benefit, a participant can elect to receive a lump sum disbursement of up to _______ percent

8. Self-payments are due on the ________ business day of each quarter of coverage

11. Excess SUB Fund contributions are deposited into the participant’s ______ account

12. Name of the Health and Benefit Plan’s third-party administrator

14. UHC is the abbreviation for_______________

15. Number of years of full vesting credit needed not to lose your right to receive a pension benefit

16. Becoming this means that you will not lose your right to receive a pension benefit

18. Name given to the Health and Benefits Plan’s third-party administrator web portal

20. Number of electrical workers who founded Local 697

21. In the last 4 years, retirees have received a 13th check, and their Pension benefit has been increased ________times

23. HRA debit cards are ____ deactivated if proper supporting documentation is not received in the allotted time span

26. In 20____ retirees were provided with dental, vision and hearing aid benefits for the first time

28. Prior to 2018, reciprocated hours were _____ permitted to be used toward the crediting of a participant’s hour bank or MRP program

29. Amount in hundreds of the annual dental allowance for retirees who are not entitled to receive Medicare

30. Government entity that prohibits the use of drug discount coupons

32. Number of MPP&T loans a participant may have out at any one time

34. The Combination of the increase in Plan P benefits, the increase in the dental benefits, the increase in Pension benefit and the decrease in the monthly Health and Benefit Plan self-payment expense, in ________ for most retired participants over the age of 65

36. Participants with this number of Plan P credits can retire early and receive the maximum Plan P allowance

37. Maximum amount in thousands that can be taken out in loans

40. Do I need to read all communications from the Fund Office?

43. ____-of-network or non-participating are the terms used to describe both the physicians who do not belong to the network and for the hospitals not directly contracted with the Health and Benefit Plan

44. The HRA benefit provides a _________ free stipend of money that can be used to offset medical, dental, pharmaceutical and visions expenses